bear trap stock example

A Bullish Bear Trap Candlestick Breaks The Support Level and Goes Down But Eventually Closes Above The Support Line Forming A Bullish Candlestick. Therefore you can only track the market closely to identify where a bear trap may have occurred.

What Is A Bear Trap On The Stock Market Fx Leaders

Example of a bear trap pattern.

. The cryptostock prices that youre following only keep on rising so you havent sold any of your assets yet in the hope of getting a bigger profit. Example of trading the bear trap pattern. This causes traders to open short positions with expectations of profiting from the assets price decline.

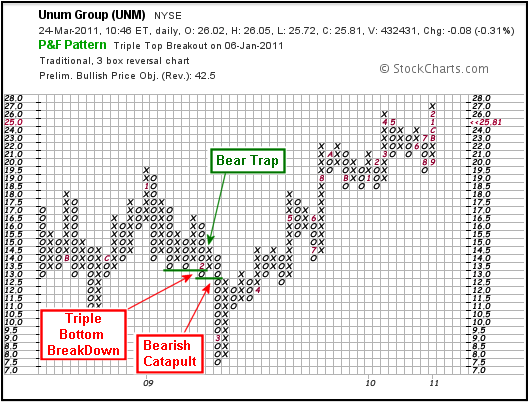

Price will be looking to breakout lower through a major support level but after moving through the level it will quickly. The chart below is for the agricultural products and services retailer Agrium Inc. What is a Bear Trap.

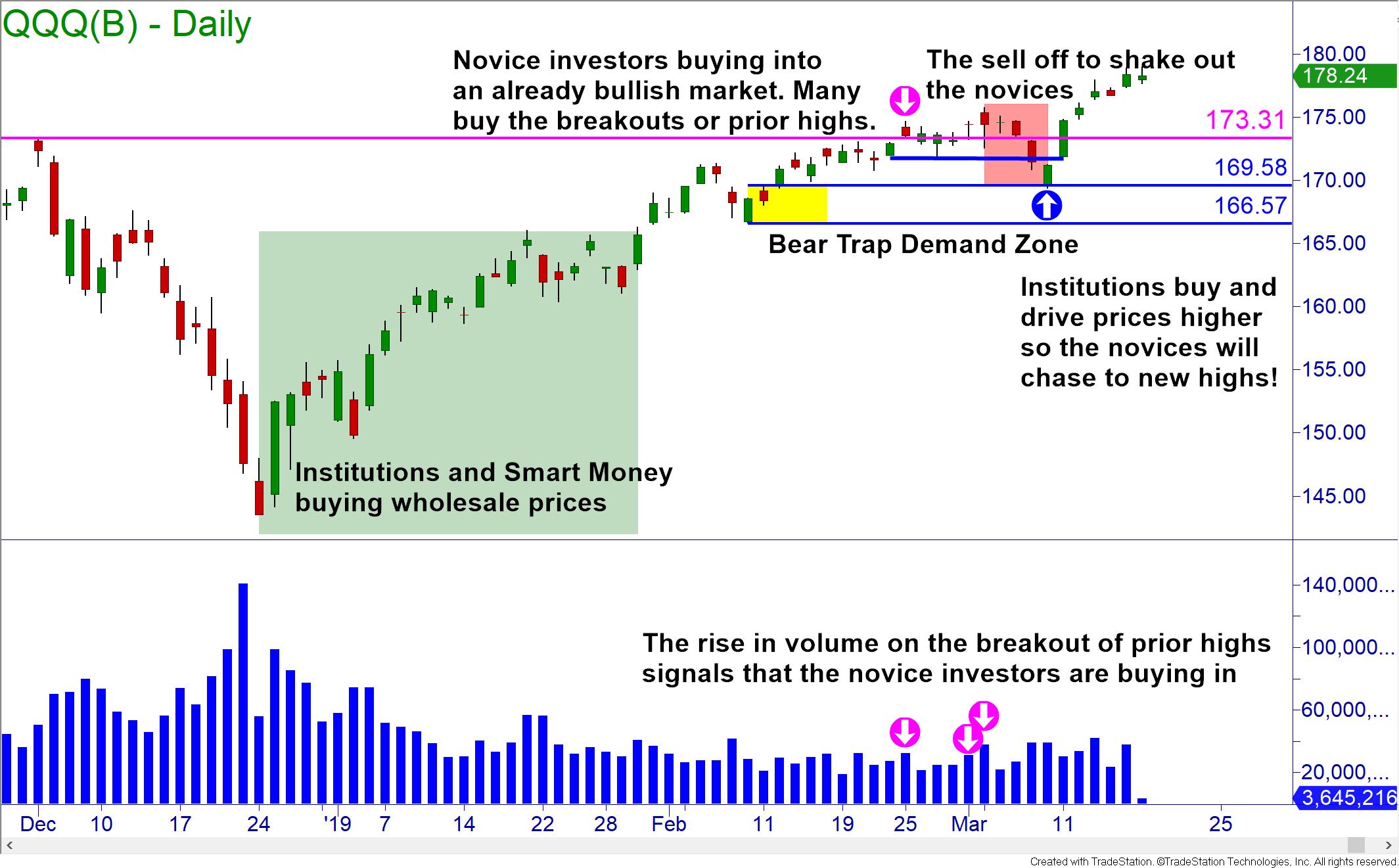

Markets move higher because of an imbalance between buying and selling pressure. Bear Trap Stock Chart Example. Bearish Candlestick Closing Above Support.

In general a bear trap is a technical trading pattern. With no central governing body institutions dont have to disclose any of their trading information. Bear Trap Example A typical bear trap works like this.

After the support is put in place just below 084 EURGBP moves higher but finds resistance at the 50 SMA yellow. Have you ever noticed price will often move just above or just below a key support or resistance level and then quickly snap back in the other direction. A Bear Trap is a technical pattern that occurs when the performance of a stock or an index incorrectly signals a reversal of a rising price trend.

A Bear Trap is a technical pattern that occurs when the performance of a stock or an index incorrectly signals a reversal of a rising price trend. In significant bear trap trading scenarios a bear trap can open the door to a short squeeze. It is a false indication of a reversal from an uptrend into a downtrend.

The bear and bull trap are created by the major market players. Bear Trap Chart 3. Illustrated below is another bear trap example with a stock.

Bear Trap Chart 2. For example intraday in forex markets or over several trading periods in the stock market. Markets rarely make v-shaped recoveries yet we.

It consists of creating a false signal in the market indicating that an asset is going to start losing its value. A bull trap is a false signal referring to a declining trend in a stock index or other security that reverses after a convincing rally and breaks a. Here price action moves sideways after a steady downside decline in price.

This occurs when the false reversal happens quickly and dramatically sending a. For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the SPDR SP 500 ETF a US stock market proxy. Bear traps can be a bit harder to spot in the crypto chart patterns than in the stock market.

The EC Comics Shock SuspenStory Stumped has a trapper setting a bear-trap for a rival trapper and then leaving him there to die. Bear Trap into a Short Squeeze. Alternatively it may cause them to sell off their stock or cryptocurrency assets in order to take profits and prevent losses.

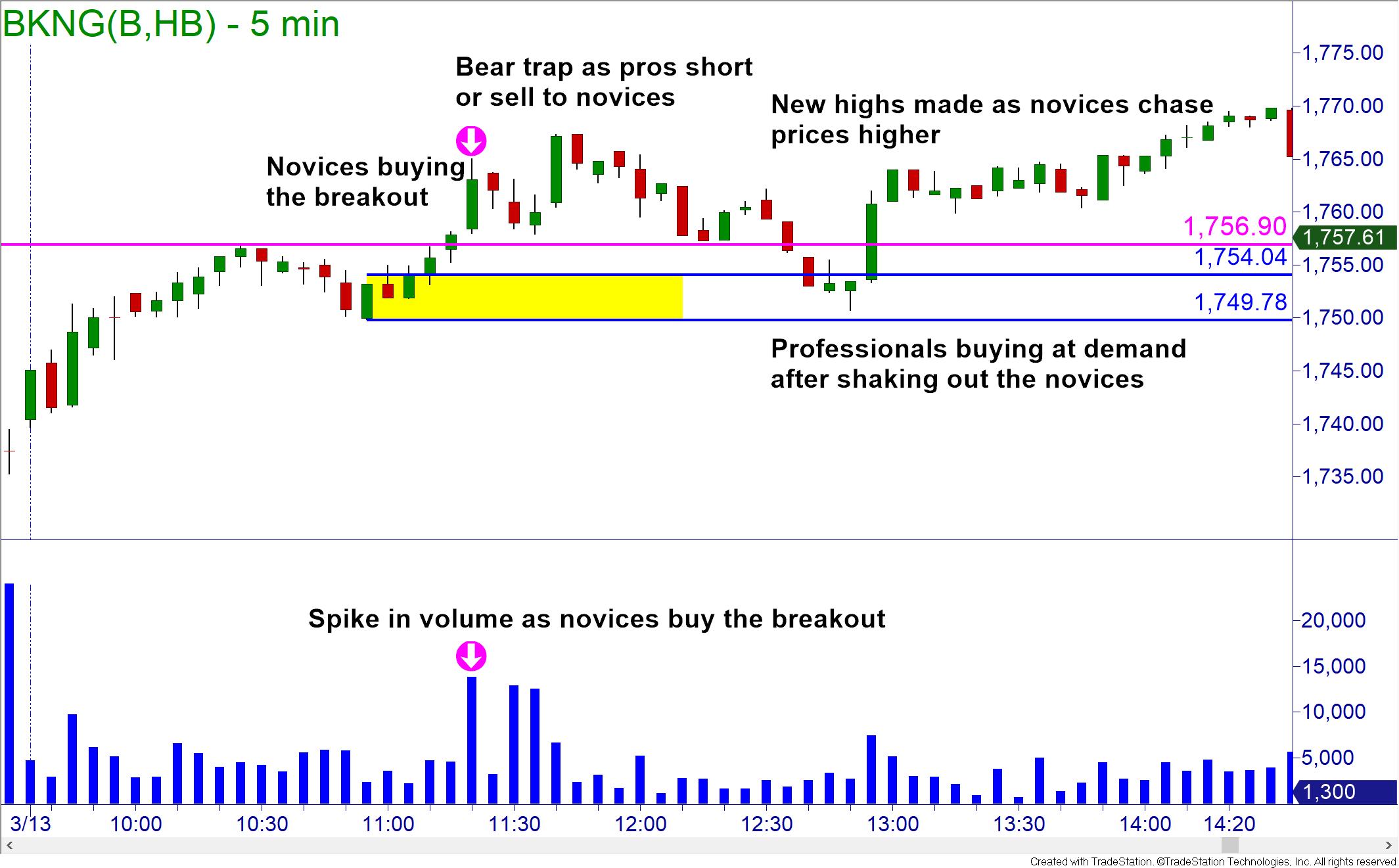

In the next example we can see a bear trap pattern. These sentiment swings can happen over various time periods. Typically betting against a stock requires short-selling margin trading or derivatives.

Markets rarely make v-shaped recoveries yet we usually hear only about the rare bottom caller that gets it right instead of the many more that call false bottoms. Bear traps spring as brokers initiate margin calls against investors. Bear Trap Chart Example.

You will notice that the stock broke to. Fresh two-day lows before having a sharp counter move higher. 3 Types of Candlesticks in Bear Traps 1.

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend. In Judge Dredd Judge Fear slings around chains with bear traps on the ends. Bear Trap Example Chart and Pattern.

Notice from this chart that the stock broke to fresh two-day lows and appeared on the surface to trend downwards before taking a sharp turn upwards. Bull Trap vs Bear Trap Explained. Here is an example of this situation shown by this bear trap chart shown below.

For example when there are a lot of people wanting to buy but no sellers. A bear trap is the opposite of a bull trap. Rising stock prices cause losses for bearish investors who are now trapped.

One such trap is the Bear Trap in Stocks. Below is an example of a bear trap on 76 for the stock. Bounce which will often precede the short-term top in the.

Following this a sideways range is established with price staying within the initial highs and lows that are formed. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. Black Panther got caught into a bear trap among the many injuries he received during the Panthers Quest story in Marvel Comics Presents.

A Bearish Bear Trap Candlestick Breaks the support level and goes down but closes above the support level. A Bear Trap in terms of trading is a strategy that institutions use to take advantage of the young traders that dont have the insight to recognise when they are being played. This is the prime example of a bear trap in financial markets.

A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. Imagine were in the middle of a bull market and youre one of the inexperienced traders looking to cash in on your investment. Bear traps occur when investors bet on a stocks price to fall but it rises instead.

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market

What Is A Bull Trap In Trading And How To Avoid It Ig En

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

P F Bull Bear Traps Chartschool

Bear Trap Stock Trading Definition Example How It Works

3 Bear Trap Chart Patterns You Don T Know

Bear Trap Best Strategies To Profit From Short Squeezes

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes

3 Bear Trap Chart Patterns You Don T Know

What Is A Bear Trap On The Stock Market

What Is A Bear Trap Seeking Alpha

Bull Traps Vs Bear Traps How To Trade With Them Phemex Academy