does tennessee have estate or inheritance tax

The majority of these states are in the northeastern part of the country and we are in the clear here in Tennessee because there is no state-level estate tax in our state. With Access To Our Free Estate Planning Checklist You Can Start Developing A Plan Today.

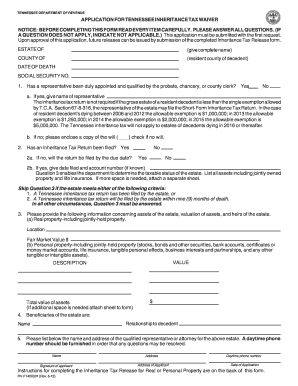

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

It is one of 38 states with no estate tax.

. For all other estates subject to the inheritance tax for deaths that occurred before December 31 2015 the inheritance tax is paid by the executor administrator or trustee and it. Due by Tax Day of the year following. The inheritance tax is paid out of the estate by the executor.

Indiana Ohio and North Carolina had estate taxes but they were repealed in 2013. Each due by tax day of the year following the individuals death. For example the neighboring state of Kentucky does have an inheritance tax.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. The estate tax is a tax on a persons assets after death. Twelve states and the District of Columbia collect an estate tax at the state level as of 2022.

Michigan is one of. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Ad Wells Fargo Will Work With You And Your Team of Advisors To Develop A Comprehensive Plan.

There are NO Tennessee Inheritance Tax. This is great news for residence. Federal state tax exemption.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. The Federal estate tax only affects02 of Estates. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Final individual federal and state income tax returns. Twelve states and Washington DC. It means that even if you are a.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Oklahoma and Kansas have also repealed their estate taxes.

Tennessee is not impose an estate tax. However it applies only to the estate physically located and transferred within the state between Tennessee residents. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses.

However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. What is the inheritance tax rate in Tennessee. Tennessee followed suit in 2016 and New Jersey and Delaware eliminated their estate taxes as of 2018.

Technically Tennessee residents dont have to pay the inheritance tax. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. What percentage is inheritance tax in Michigan.

Those who handle your estate following your death though do have some other tax returns to take care of such as. Tennessee estate tax. But dont forget about the federal estate tax.

There are 12 states that have state-level estate taxes and there is a Washington DC. Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95.

Any amount in excess of the federal exemption will be subject to estate tax. Tennessee does not have an estate tax. All inheritance are exempt in the State of Tennessee.

Federal estatetrust income tax return. When other states refer to inheritance taxes they are not referring to the total value of an estate. Impose estate taxes and six impose inheritance taxes.

Maryland is the only state to impose both. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. What Other Taxes Must be Paid.

The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. As of December 31 2015 the inheritance tax was eliminated in Tennessee. How do the inheritance and estate tax laws work in Tennessee.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. In 2015 the Tennessee estate tax applied to high value estates that were worth more than 5 million.

All inheritance are exempt in the State of Tennessee. Tennessee is an inheritance tax and estate tax-free state. There are NO Tennessee Inheritance Tax.

Tennessee does not have an inheritance tax either. Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that were valued over a certain dollar amount. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates.

Inheritance Tax in Tennessee. In fact it doesnt matter the size of your estate there will be no state level tax assessed.

Where S My Tennessee Tn State Tax Refund Taxact Blog

Estate Planning Tax Rule You Should Know Batsonnolan Com

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Who Are Next Of Kin In Tennessee Probate Stars

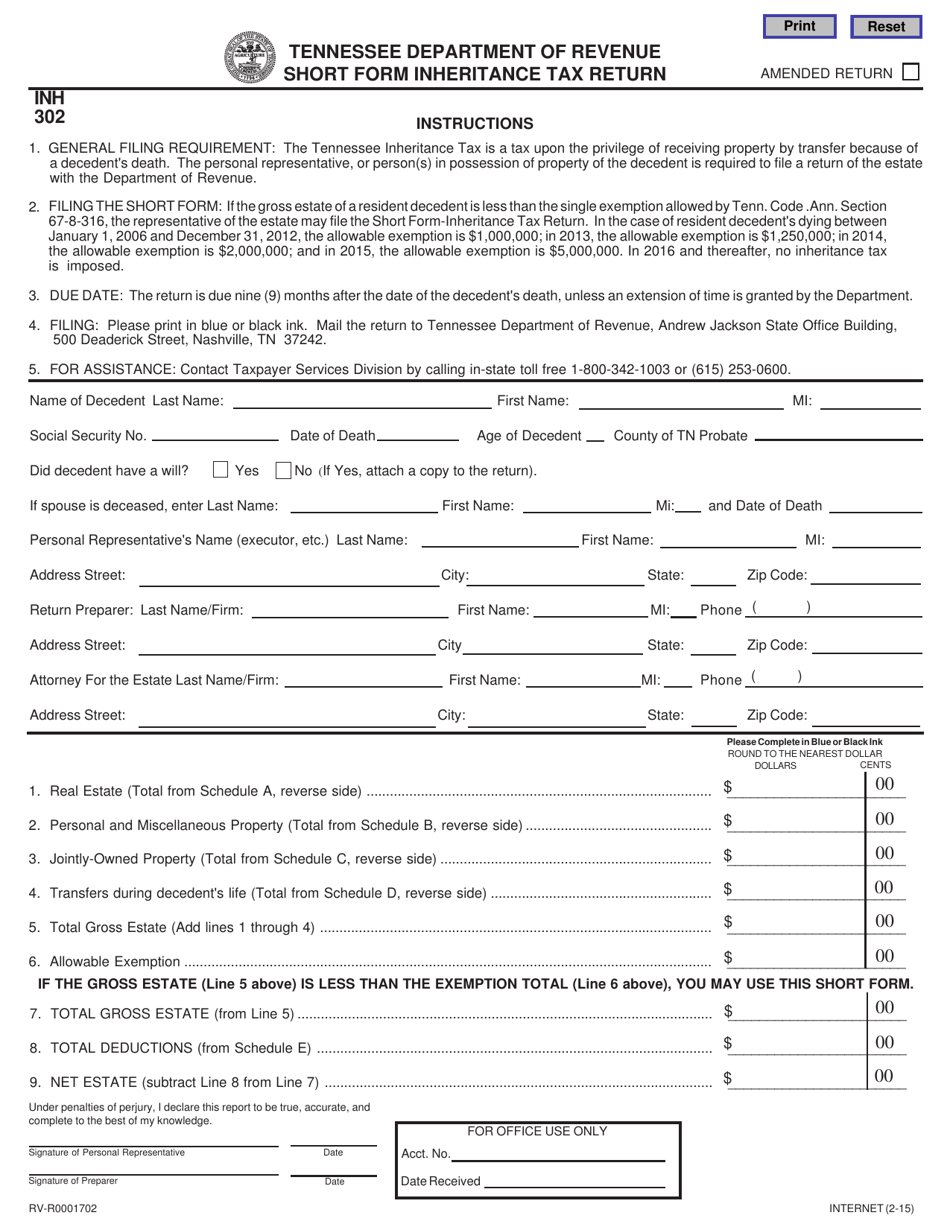

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

How Long Does The Tennessee Probate Process Take And What S Involved Epstein Law Firm

Who Are Next Of Kin In Tennessee Probate Stars

Estate Planning In Tennessee Could You Benefit From A Community Property Trust Trustcore

Economy Of Tennessee Wikipedia

The 35 Fastest Growing Cities In America City Cheap Houses For Sale Best Places To Live

Tennessee Taxes Do Residents Pay Income Tax H R Block

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Estate Planning In Tennessee Could You Benefit From A Community Property Trust Nashville Business Journal

Probate Fees In Tennessee Updated 2021 Trust Will